NEW YORK — Less than a month after writing he did not want to “cook the books anymore,” but facing a deadline to show lenders that Dewey & LeBoeuf had enough cash, the law firm’s top finance executive e-mailed a colleague that he “came up with a big one,” according to investigators.

“You always do in the last hours,” the law firm’s executive director Stephen DiCarmine replied to the Dec. 29, 2008 e-mail from chief financial officer Joel Sanders, according to investigators. “That’s why we get the extra 10 or 20 per cent bonus.”

“You always do in the last hours,” the law firm’s executive director Stephen DiCarmine replied to the Dec. 29, 2008 e-mail from chief financial officer Joel Sanders, according to investigators. “That’s why we get the extra 10 or 20 per cent bonus.”

The communications and other evidence are the basis of criminal and civil charges announced in New York on Thursday against six former officials at the now-defunct law firm, which once had as many as 1,400 lawyers before going bankrupt in May 2012.

Manhattan District Attorney Cyrus Vance Jr. charged former Dewey & LeBoeuf chairman Steven Davis, 60, DiCarmine, 57, and Sanders, 55, with several dozen felonies each over the firm’s collapse, including grand larceny, securities fraud, and falsifying business records.

Lawyers for those three executives said their clients did not commit any crimes.

The U.S. Securities and Exchange Commission filed related civil fraud charges against the three men and former finance director Frank Canellas, 34, and former controller Thomas Mullikin, 43, for cheating 13 insurers that took part in a $150-million bond offering in 2010.

Another defendant, client relations manager Zachary Warren, 29, was also criminally charged.

At a press conference, Vance said Dewey’s finance department ran a “blatant accounting fraud and deceit” at the direction of the firm’s top management, and that officials gave false information to the law firm’s auditor, Ernst & Young.

The prosecutor also said the fraud began in late 2008 during the financial crisis, and continued as Davis authorized “generous” salaries and bonuses for top lieutenants, even as many other law firm employees saw their pay go down.

Seven people, whose names have not been publicly disclosed, have already pleaded guilty in the case, and the investigation is continuing, said Vance.

Dewey & LeBoeuf was formed in a 2007 merger of two prestigious New York law firms, Dewey Ballantine and LeBoeuf Lamb Greene & MacRae. Its collapse is the largest of a U.S. law firm, costing thousands of jobs and hundreds of millions of dollars of estimated losses for banks, lenders and investors.

Elkan Abramowitz, a lawyer for Davis, said Davis’ actions as chairman “were taken in good faith in an effort to make the firm a success,” and that evidence will show he committed no crime.

DiCarmine’s and Sanders’ respective lawyers, Austin Campriello and Edward Little, also said their clients did not commit any crimes. “This indictment is guilty of scapegoating,” Campriello said.

Lawyers for the other defendants did not immediately respond to requests for comment or could not immediately be reached. Amy Call Well, an Ernst & Young spokeswoman, declined to comment.

Investigators said the fraud began in late 2008, when Dewey executives began misrepresenting the law firm’s compliance with cash flow and other loan covenants.

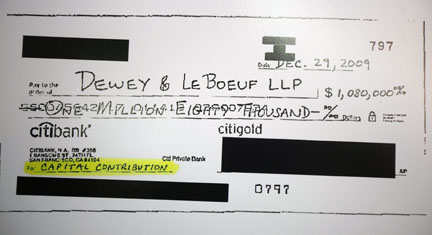

Prosecutors accused Davis, DiCarmine ,and Sanders of covering their tracks by misclassifying revenue and expenses to make Dewey’s books look better, and trying to backdate checks.

The men were also accused by Vance of having stolen nearly $200 million from 13 insurers and two financial institutions.

Evidence included a note from Sanders to two employees after he had learned in 2011 that Dewey did not write off millions of dollars of a troubled client’s receivables.

“We need to hide this actually writing it off,” Sanders allegedly wrote, according to Vance.

The SEC case focuses on the regulator’s allegations that investors were misled about Dewey’s finances in marketing materials for the 2010 bond offering, which it said was conducted “to alleviate the burden of its crushing debt.”

Among its evidence was a schedule of proposed cost cuts that was labeled “Accounting Tricks,” and DiCarmine’s hopes for a larger bonus.

“We’ll buy a ski house next. Just need to keep the ship a float,” DiCarmine told Sanders, according to investigators.

“Investors were led to believe they were purchasing bonds issued by a prestigious law firm that had weathered the financial crisis and was poised for growth,” said SEC enforcement chief Andrew Ceresney.

He called the bond sale “a desperate grasp for cash on the basis of blatantly falsified financial results.”

The SEC seeks to impose civil fines and recoup any illegal gains from defendants.

The cases are New York v. Davis et al, New York State Supreme Court, New York County, and SEC v. Davis et al, U.S. District Court, Southern District of New York, No. 14-1528.

“You always do in the last hours,” the law firm’s executive director Stephen DiCarmine replied to the Dec. 29, 2008 e-mail from chief financial officer Joel Sanders, according to investigators. “That’s why we get the extra 10 or 20 per cent bonus.”

“You always do in the last hours,” the law firm’s executive director Stephen DiCarmine replied to the Dec. 29, 2008 e-mail from chief financial officer Joel Sanders, according to investigators. “That’s why we get the extra 10 or 20 per cent bonus.”The communications and other evidence are the basis of criminal and civil charges announced in New York on Thursday against six former officials at the now-defunct law firm, which once had as many as 1,400 lawyers before going bankrupt in May 2012.

Manhattan District Attorney Cyrus Vance Jr. charged former Dewey & LeBoeuf chairman Steven Davis, 60, DiCarmine, 57, and Sanders, 55, with several dozen felonies each over the firm’s collapse, including grand larceny, securities fraud, and falsifying business records.

Lawyers for those three executives said their clients did not commit any crimes.

The U.S. Securities and Exchange Commission filed related civil fraud charges against the three men and former finance director Frank Canellas, 34, and former controller Thomas Mullikin, 43, for cheating 13 insurers that took part in a $150-million bond offering in 2010.

Another defendant, client relations manager Zachary Warren, 29, was also criminally charged.

At a press conference, Vance said Dewey’s finance department ran a “blatant accounting fraud and deceit” at the direction of the firm’s top management, and that officials gave false information to the law firm’s auditor, Ernst & Young.

The prosecutor also said the fraud began in late 2008 during the financial crisis, and continued as Davis authorized “generous” salaries and bonuses for top lieutenants, even as many other law firm employees saw their pay go down.

Seven people, whose names have not been publicly disclosed, have already pleaded guilty in the case, and the investigation is continuing, said Vance.

Dewey & LeBoeuf was formed in a 2007 merger of two prestigious New York law firms, Dewey Ballantine and LeBoeuf Lamb Greene & MacRae. Its collapse is the largest of a U.S. law firm, costing thousands of jobs and hundreds of millions of dollars of estimated losses for banks, lenders and investors.

Elkan Abramowitz, a lawyer for Davis, said Davis’ actions as chairman “were taken in good faith in an effort to make the firm a success,” and that evidence will show he committed no crime.

DiCarmine’s and Sanders’ respective lawyers, Austin Campriello and Edward Little, also said their clients did not commit any crimes. “This indictment is guilty of scapegoating,” Campriello said.

Lawyers for the other defendants did not immediately respond to requests for comment or could not immediately be reached. Amy Call Well, an Ernst & Young spokeswoman, declined to comment.

Investigators said the fraud began in late 2008, when Dewey executives began misrepresenting the law firm’s compliance with cash flow and other loan covenants.

Prosecutors accused Davis, DiCarmine ,and Sanders of covering their tracks by misclassifying revenue and expenses to make Dewey’s books look better, and trying to backdate checks.

The men were also accused by Vance of having stolen nearly $200 million from 13 insurers and two financial institutions.

Evidence included a note from Sanders to two employees after he had learned in 2011 that Dewey did not write off millions of dollars of a troubled client’s receivables.

“We need to hide this actually writing it off,” Sanders allegedly wrote, according to Vance.

The SEC case focuses on the regulator’s allegations that investors were misled about Dewey’s finances in marketing materials for the 2010 bond offering, which it said was conducted “to alleviate the burden of its crushing debt.”

Among its evidence was a schedule of proposed cost cuts that was labeled “Accounting Tricks,” and DiCarmine’s hopes for a larger bonus.

“We’ll buy a ski house next. Just need to keep the ship a float,” DiCarmine told Sanders, according to investigators.

“Investors were led to believe they were purchasing bonds issued by a prestigious law firm that had weathered the financial crisis and was poised for growth,” said SEC enforcement chief Andrew Ceresney.

He called the bond sale “a desperate grasp for cash on the basis of blatantly falsified financial results.”

The SEC seeks to impose civil fines and recoup any illegal gains from defendants.

The cases are New York v. Davis et al, New York State Supreme Court, New York County, and SEC v. Davis et al, U.S. District Court, Southern District of New York, No. 14-1528.