As big firms look to shed surplus capacity, highly paid, non-equity partners and senior associates are more vulnerable to staff reductions than those on the bottom rung.

That’s one of the more surprising findings in Altman Weil’s annual Law Firms in Transition survey, released yesterday, which paints a bleak portrait for big law firms whose prospects are being dragged down by overcapacity, technological disruption, competition on multiple fronts, and a cultural resistance to change.

That’s one of the more surprising findings in Altman Weil’s annual Law Firms in Transition survey, released yesterday, which paints a bleak portrait for big law firms whose prospects are being dragged down by overcapacity, technological disruption, competition on multiple fronts, and a cultural resistance to change.

The survey canvassed managing partners and other law firm leaders at 356 firms with 50-plus lawyers across the United States to gauge perceptions around business prospects and competitive pressures facing the industry.

While 62 per cent of all law firm leaders believed that an erosion of demand was a “permanent trend,” law firms have generally not felt “enough economic pain” to warrant significant changes. As it stands, only 44 per cent of firms have made significant strategic changes to enhance efficiency, and only one-third of firms have looked at changing their basic pricing structure.

However, as the number of firms experiencing sharp drops in profit grows (up four points to 10 per cent in 2015), law firm leaders have begun to shift work to lower-paid lawyers. Already, according to the study, three-quarters of big firms are using part-time and contract lawyers.

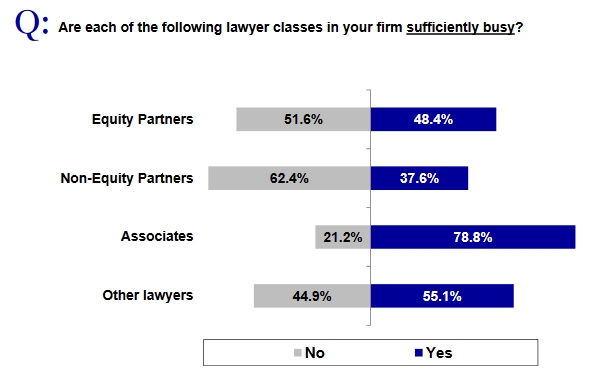

And when managing partners were asked which tier of lawyers were considered “least busy,” they pointed not to low-level associates, but rather to their non-equity partners. Fully 62 per cent of managing partners felt their non-equity partners weren’t sufficiently busy, suggesting an ominous potential for cost savings.

As Catalyst Consulting’s Richard Stock puts it, the firms are moving away from the “pyramid” structure and toward more of an “hourglass” — top-loaded with senior partners, bottom-loaded with worker drones.

“Anywhere between six and 12 years of call — and it could be very senior associates or it could be non-equity partners or of counsel — that combination of individuals are the most vulnerable,” says Stock.

“Anywhere between six and 12 years of call — and it could be very senior associates or it could be non-equity partners or of counsel — that combination of individuals are the most vulnerable,” says Stock.

The trend has particularly negative implications for young lawyers looking to land at a big firm and eventually get on a partnership track. According to Stock, that career path is quickly vanishing.

“What they do is, they simply don’t retain as many past the third-year call,” he says. “So essentially they’re hiring worker bees . . . who have no expectation of getting on a partnership track at that stage of life. They’re just happy to do large volumes of work and pay down their debt and then make a decision in three or four years.

“Unless you’re on a specialist track, you’re going to end up like Prince Charles waiting 70 years to inherit the throne. It’s just not going to happen.”

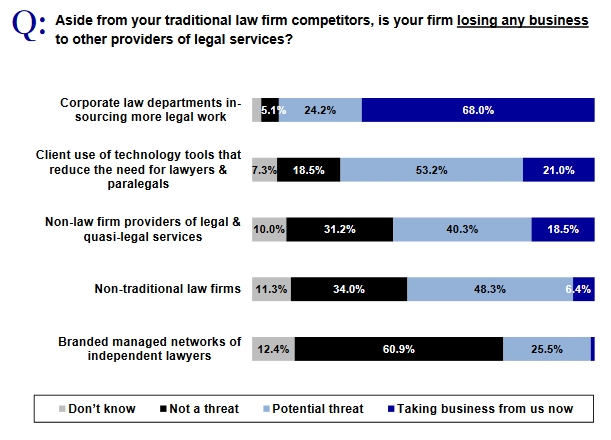

The study also underscores what law firm leaders perceive to be the greatest competitive threats — and it’s not technological automation of routine work. Rather, in-sourcing is cited as the most immediate competitive concern: 83 per cent of large firms report having business taken in-house by their client; another 15 per cent view it as a potential threat, leaving less than two per cent of large firm leaders who don’t see it as a concern.

Stock says this is no surprise, given the corporate-commercial, transactional, and commoditized business work that has for decades been the bread and butter of national full-service firms. Litigation, however, is another matter entirely, he notes.

“There’s no move to in-source litigation,” he says. “So I think that’s true when you’re talking about transactions and corporate-commercial work. The big-box firms have always had a relatively small percentage of their fee earners in litigation. They have not been set up like a Lenczner Slaght or other litigation shops.”

Generally speaking, however, Stock says Canadian firms are more protected than their American peers, given that the most vulnerable corporate-commercial work is contained in Toronto. Law departments here, meanwhile, are much smaller in than those in the U.S., and so less capable of in-sourcing the really big projects.

“We can't forget that in Canada, compared to the United States, 50 per cent of corporate law departments have fewer than five lawyers. And another 25 per cent have fewer than 10 lawyers. You're not going to do a big transaction with just that.”

Despite intense competitive pressures, Altman Weil’s report finds that law firm partnerships suffer from cultural inertia, if not outright apathy. In one remarkable statistic, nearly one-third of law firm leaders believed that the partners in their firms would rather make less money than lose the ability to manage their own affairs.

“In other words,” as the report puts it, “they would actually pay to be left alone.”

This demand for independence and autonomy is what puts the collective law firm at risk from team-oriented corporations and accountancies. Stock says this kind of “ostrich behaviour” won’t last for long.

“If you’ve got some sense of trying to run a business — and this is a Deloitte quote from 25 years ago — you cannot save your way to prosperity. To reduce your expense structure, redesign your compensation structure — it’s always too little. All that buys you is a few years.”