Has the turnaround finally begun for energy M&A this year?

Deal lawyers in the oil and gas sector have bemoaned the dearth of activity this year, as the late 2014 oil crash led to a prolonged episode of doldrums.

Just how bad has it been?

Just how bad has it been?

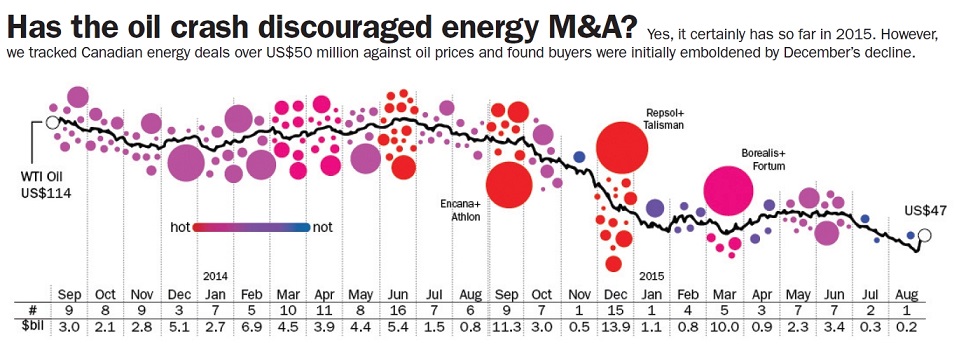

From January to August 2014, energy lawyers in this country feasted on 70 significant energy deals worth a combined $30.1 billion (see graphic). This year, by comparison, we’ve seen a measly 30 deals valued at $19 billion. Slim pickings by all accounts.

News this week, however, may have given mergers and acquisitions advisers a glimmer of hope. On Monday, as OPEC hinted at softer competition with oil sands producers, U.S. Federal Reserve chairwoman Janet Yellen declined to raise interest rates, putting the greenback under pressure and giving oil prices a lift.

Monday saw a 5-per-cent jump in petroleum prices — which are up 20 per cent from their August lows — and those gains seem to be solid.

To put a capper on it, again on Monday, Suncor Energy — frustrated by rebuffed overtures — broke the Canadian deal slump with its $4.3-billion hostile takeover for Canadian Oil Sands.

Shares of COS spiked 50 per cent on news of the bid. COS, attempting to extract a higher price or find a white night, responded yesterday by announcing a 120-day shareholder rights plan (aka, a poison pill).

Cautious optimism

So, do all these factors amount to a sign of life in the energy M&A market? Craig Hoskins, a Calgary deals lawyer at Norton Rose Fulbright Canada LLP, says there’s reason to be “cautiously optimistic,” as the saying goes.

“My first reaction was, ‘Yeah, that’s great, you know. We’ll have a nice big data point, and it’ll be really helpful to maybe jog some other deals out of the tree,” he says. “But I wouldn’t be overestimating how significant it might be at the end of the day.”

After all, says Hoskins, the Suncor bid for COS may be an exception, given that the companies are already partners in the Syncrude oil sands project.

And even if oil prices are rising, they aren’t the only factor inhibiting M&A in the energy sector, says Hoskins. There’s also the election of the NDP government in Alberta, and its looming royalty review process; and then there’s the issue of getting the crude to points of sale, as provinces and First Nations line up against pipeline proposals.

Hoskins, however, does allow that softening competition from Saudi Arabia and OPEC nations could at least put a floor on the price of oil, which would provide greater deal certainty for transactional partners.

While investors in the oil and gas sector are desperate for a rebound, M&A lawyers would like to see some of that desperation preserved.

“If prices are rising, then the sellers are not as compelled,” he says. “There can be a stabilization, but if these financially distressed companies don’t see a solution in the short to medium term because prices aren’t going up, they’re going to be forced to take the reckoning and do the deal.”