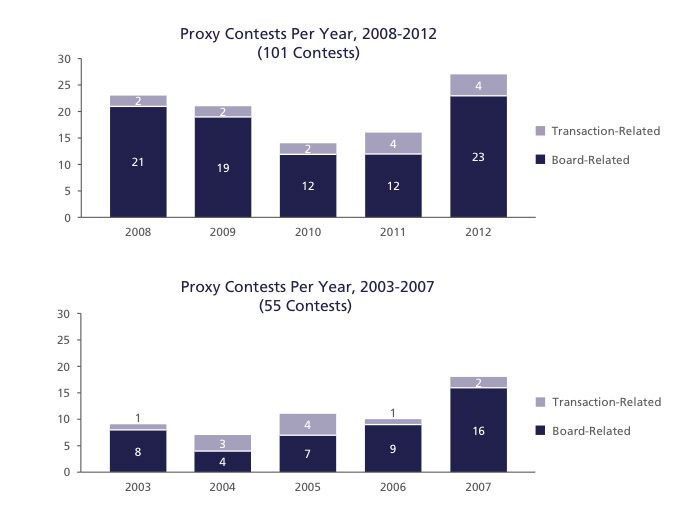

Proxy contests have gone up by 84 per cent in the past five years, and during that time there has also been a 98-per-cent increase in the number of contests that focused solely on changing the board.

Proxy contests have gone up by 84 per cent in the past five years, and during that time there has also been a 98-per-cent increase in the number of contests that focused solely on changing the board. These are some of the findings of Fasken Martineau DuMoulin LLP’s “Canadian Proxy Contest Study” released today.

Proxy contests have come into the spotlight in recent years, especially with last year’s high-profile Canadian Pacific Railway dispute. Telus Inc., Agrium Inc., and Rona Inc. were also involved in proxy fights in 2012.

Aaron Atkinson, a partner at Faskens and one of the authors of the study, says it was conducted to gather empirical data on proxy contests — something you don’t see very often in Canada.

“There has been a lot written about proxy contests in recent years . . . and so I think there was a lot of speculation about how shareholders were doing in the fights and so forth, but from what we could tell there was limited actual empirical data on what were the actual outcomes, what were the tactics people were employing, and what kind of success might they be having in employing those tactics,” Atkinson tells Legal Feeds.

The study lists five main findings:

1. It’s true: proxy contests are on the rise.

A total of 101 contests were completed during the 2008-12 study period, representing an 84-per-cent increase over the preceding five-year period. The last five years also witnessed a 98-per-cent increase in the number of contests focused on change in the boardroom.

2. Dissidents achieved success well over half of the time.

In 54 per cent of all board-related contests, dissidents were successful in their public campaign for board change.

3. No one is immune.

Issuers of all sizes and in all industries were the targets of board-related contests. Indeed, the composition of companies targeted in board-related contests almost mirrored the composition of Canadian-listed issuers by size and industry sector.

4. Dissidents often benefit from a high-stakes game.

A high-stakes approach appeared to benefit the dissident in board-related contests. Higher success rates were associated with:

• having more "skin in the game" with a significant equity stake;

• employing "winner takes all" tactics, including by seeking a clean sweep of the boardroom;

• waging a lengthier public campaign despite the added costs.

5. True settlement is elusive.

Once a board-related contest was publicly initiated, it almost always went the distance. Fewer than one in five board-related contests during the study period ended with an announced settlement. Moreover, a quarter of these settlements may have been less motivated by compromise than by a desire to ensure an orderly outcome to a foregone conclusion.

The fact that shareholders seeking change were successful more than half the time, “you wonder whether there’s in part a snowball effect because obviously if there’s some success in the market you might have others thinking this is a useful tool,” says Atkinson.

The big question is whether proxy contests are going to be a permanent trend in the Canadian economy, he says.

“If you look at the market returns in the preceding year, a higher number of proxy contests tend to happen in years following poor market returns. So you’ve got disgruntled shareholders who are looking for change because the stock price is falling,” says Atkinson.

“So the question is if the economy does improve — as people seem to be hinting at — and therefore stock market returns improve, do shareholders maybe have a less compelling case for change because happy shareholders are less likely to vote out the board? So if the markets turn around maybe you’ll see fewer [proxy contests], but at the same time, if in fact proxy contests are more motivated by this larger shareholder democracy trend then maybe they will be here to stay.”